A quota share is an agreement whereby the cedant cedes and the reinsurer accepts a fixed proportion of each and every risk within a defined category of business written by the cedant.

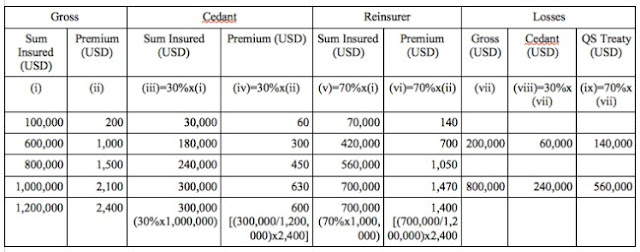

The proportion is established at the inception of the treaty. The reinsurer receives that proportion of original premiums and pays the same proportion of losses. Quota share treaties are normally expressed as percentage arrangements; for example, 50 percent quota share or 70 percent quota share. A quota share treaty also specifies the maximum monetary amount that is to be shared. This might be expressed as: Quota share to accept 70 percent of every risk insured, not exceed 1,000,000 any one risk. Another possible restriction is that the percentage kept by the cedant must not be further reinsured but kept for his own account.

70% Quota Share with a Maximum of USD 1,000,000 Any One Risk

Other things being equal,

a quota share treaty commands higher levels of ceding commission than

other forms of proportional arrangements, because the reinsurer gets

a predetermined share of all risks, including small ones, and there

is little possibility of anti-selection against the reinsurer.

Quota share reinsurance

is particularly appropriate when:

- An insurer embarks on a new line of business for which no statistics exist and the outcome is uncertain, but the reinsurer has confidence in the underwriting of the insurer. Thus, quota share facilitates the development of new lines of business.

- In view of the specialised nature of the business, e.g., Bond of Contractors' All Risk insurance, the reinsurer wishes to directly influence the underwriting through participation in all risks written by the cedant.

- The class of business has moderate sums insured per unit but aggregate exposure to catastrophes is high.

- An insurer wishes to reduce his net retained account for purposes of compliance with solvency requirements.

- Reinsurance on a surplus basis is not available, or the size of the treaty is limited owing to past adverse results.

- It is difficult to assess the amount to be retained, e.g., in case of unlimited liability insurance, and export guarantee insurance.

- An insurer wishes to build capacity on the basis of a high gross retention. For example, if an insurer does not propose to keep more than say, 100,000 on risks underwritten for the net retained account, he can plan to have a 'Gross Retention' of 200,000 with a 50 percent quota share.

- An insurer wishes to transfer the entire portfolio to another insurer. 100 percent quota share reinsurance is used as the instrument.

The relationship of a

quota share treaty with other reinsurance arrangements of the insurer

needs to be noted. A 'Gross Account Quota Share' implies that the

entire portfolio is subject to sharing of risks on a fixed percentage

basis; a 'Net Account Quota Share' means that other reinsurance

arrangements would inure, or pay first, and the Quota Share applies

to the net retained account. A higher ceding commission can be

expected for Net Account than for Gross Account Quota Share.

Source:

Ashok Goenka. 2003. Practical Aspects Of Reinsurance. Singapore College of Insurance.

Source:

Ashok Goenka. 2003. Practical Aspects Of Reinsurance. Singapore College of Insurance.

Previous

« Prev Post

« Prev Post

Next

Next Post »

Next Post »

Quota Share Treaty Reinsurance

4/

5

Oleh

Fajar Nindyo